osceola county property tax calculator

North Carolinas median income is 55928 per year so the median yearly property. The median property tax in Oklahoma is 79600 per year074 of a propertys assesed fair market value as property tax per year.

Osceola County Fl Property Tax Search And Records Propertyshark

Douglas County has one of the highest median property taxes in the United States and is ranked 200th of the 3143 counties in order of median property taxes.

. West Virginia has one of the lowest median property tax rates in the United States with only two states collecting a lower median property tax than West Virginia. TAX DAY IS APRIL 17th - There are 172 days left until taxes are due. In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313 mills.

The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. Data sourced from the US. The exact property tax levied depends on the county in Oregon the property is located in.

In our calculator we take your home value and multiply that by your countys effective property tax rate. Oregon is ranked 16th of the 50 states for property taxes as a percentage of median income. You can calculate the cost using the same method for mortgage tax.

King County collects the highest property tax in Texas levying an average of 156 of median home value yearly in property taxes while Terrell County has the. The median property tax in Kentucky is 84300 per year072 of a propertys assesed fair market value as property tax per year. To get your exact property tax liabilities contact the Palm Beach County Tax Assessor.

Clark County collects on average 072 of a propertys assessed fair market value as property tax. The median property tax in Rockwall County Texas is 4054 per year for a home worth the median value of 189000. Washoe County collects the highest property tax in Nevada levying an average of 064 of median home value yearly in property taxes while Esmeralda County has.

The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. To find detailed property tax statistics for any county in Michigan click the countys name in the data table above. Florida Property Tax Calculator.

West Virginias median income is 44940 per year so the median yearly property tax. Each receive funding partly through these taxes. The average effective property tax rate in Macomb County is 168.

If the home you buy is located in Miami-Dade County the tax rate is 060 per 100. Clark County has one of the highest median property taxes in the United States and is ranked 546th of the 3143 counties in order of median property taxes. Kentuckys median income is 50545 per year so the median yearly property tax paid by.

Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected. The median property tax in Douglas County Nebraska is 2784 per year for a home worth the median value of 141400. The exact property tax levied depends on the county in Pennsylvania the property is located in.

North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina. The exact property tax levied depends on the county in Texas the property is located in. The countys average effective property tax rate of 148 is also lower than the state average of 153 but still higher than the 107 national average.

Oklahoma has one of the lowest median property tax rates in the United States with only six states collecting a lower median property tax than Oklahoma. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky.

The state transfer tax is 070 per 100. Westchester County collects the highest property tax in New York levying an average of 162 of median home value yearly in property taxes while St. Clackamas County collects the highest property tax in Oregon levying an average of 085 of median home value yearly in property taxes while Gilliam County has.

Chester County collects the highest property tax in Pennsylvania levying an average of 125 of median home value yearly in property taxes while. Harris County collects on average 231 of a propertys assessed fair market value as property tax. The median property tax in Harris County Texas is 3040 per year for a home worth the median value of 131700.

Rockwall County has one of the highest median property taxes in the United States and is ranked 65th of the 3143 counties in order of median property taxes. Washtenaw County collects the highest property tax in Michigan levying an average of 181 of median home value yearly in property taxes while Luce County. Los Angeles County has one of the highest median property taxes in the United States and is ranked 160th of the 3143 counties in order of.

Start filing your tax return now. Rockwall County collects on average 214 of a propertys assessed fair market value as property tax. Meanwhile if its a commercial property that you want to check you may visit Commercial Property AppraisalThey would gladly help with your property appraisal.

Property taxes in Dubuque County are cheaper than those in the rest of Iowas largest counties. This data is based on a 5-year study of median property tax rates on owner-occupied homes in Michigan conducted from 2006 through 2010. The median property tax in West Virginia is 46400 per year049 of a propertys assesed fair market value as property tax per year.

Important If you need legal advice regarding your property go to NoloIts always a good idea to get a legal opinion or even help about your property this wont break your bank and can save a lot of. The transfer tax is usually paid for by the seller but that will depend on what terms you negotiate when you put an offer on the property. New York is ranked 6th of the 50 states for property taxes as a percentage of median income.

The median property tax in Los Angeles County California is 2989 per year for a home worth the median value of 508800. The exact property tax levied depends on the county in New York the property is located in. Actual property tax assessments depend on a number of variables.

The exact property tax levied depends on the county in Nevada the property is located in. Michigan is ranked 10th of the 50 states for property taxes as a percentage of median income. This largely suburban county northeast of Detroit has property tax rates that rank fairly high nationally.

Harris County has one of the highest median property taxes in the United States and is ranked 152nd of the 3143 counties in order of median property taxes. Pennsylvania is ranked 13th of the 50 states for property taxes as a percentage of median income. Douglas County collects on average 197 of a propertys assessed fair market value as property tax.

Tulsa County collects on average 106 of a propertys assessed fair market value as property tax. Census Bureau American Community Survey 2006-2010. Los Angeles County collects on average 059 of a propertys assessed fair market value as property tax.

Texas is ranked 12th of the 50 states for property taxes as a percentage of median income. Nevada is ranked 28th of the 50 states for property taxes as a percentage of median income. Oklahomas median income is 52889 per year so the median yearly property tax paid by.

Census Bureau The Tax Foundation and various state and. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Palm Beach County. The exact property tax levied depends on the county in Michigan the property is located in.

This is equal to the median property tax paid as a percentage of the median home value in your county. The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300.

School Board Meeting Agenda Packet Osceola County

Florida Income Tax Calculator Smartasset

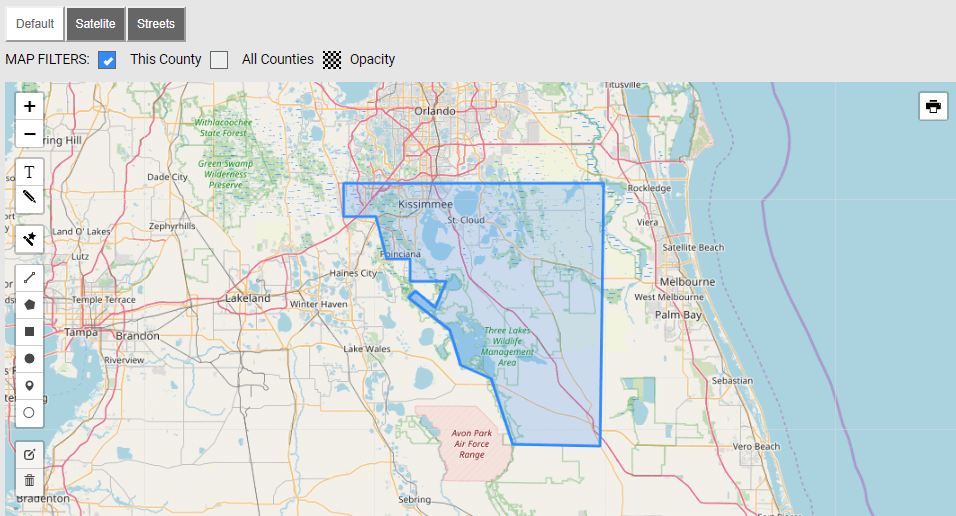

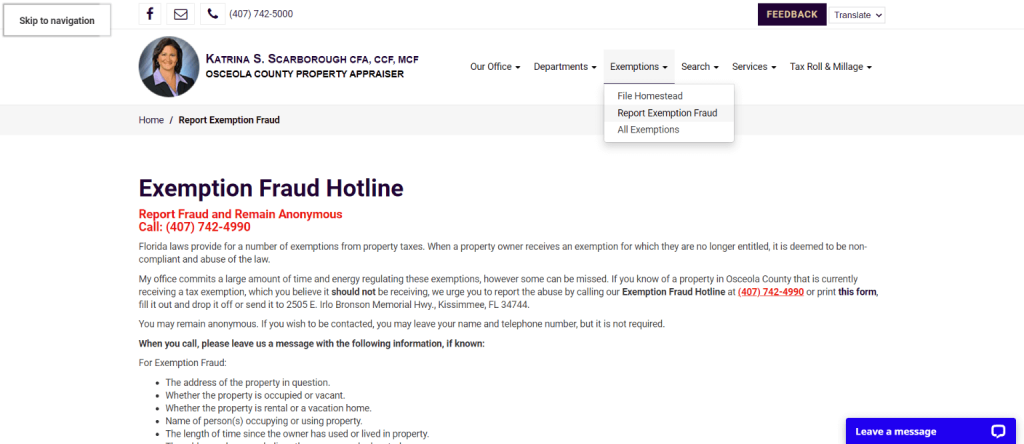

Osceola County Property Appraiser S Public Outreach Program

4011 South Orange Blossom Trail Kissimmee Fl 34746 Compass

Osceola County Fl Property Tax Search And Records Propertyshark

Property Tax Calculator Estimator For Real Estate And Homes

Property Tax Estimator Tools By County

Property Tax By County Property Tax Calculator Rethority

Home Osceola County Bs A Online

Palm Beach County Fl Property Tax Search And Records Propertyshark

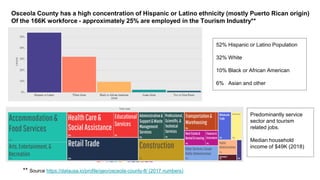

Osceola County Property Appraiser Richr

Property Tax Calculator Estimator For Real Estate And Homes

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

What Is Florida County Tangible Personal Property Tax